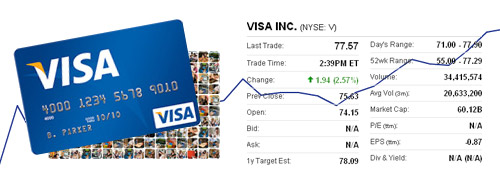

I get a fair amount of traffic to my post on Visa Stock. And it’s clear by the search terms that a lot of people are wondering ‘Should I buy Visa’?

If you got in on the IPO at $44, you’re a pretty happy camper. Even if you got in on opening day at around $60 it’s still a pretty sweet deal. But what about now? As the price continues to rise?

Hindsight is Not 20/20

You know how people buy lottery tickets and they’re just one number out from winning a couple grand. “Ohhh, I had 42 instead of 43”.

Well, you could have had 10 or 7 or 22 and you’re just as far away from 43 as you are with the number 42. A different ball came down the chute. Period.

What hindsight does is give us history. It gives us experience. And that’s the true value of it. It can’t tell us the future, but it can lead us in the right direction the next time a great opportunity comes along.

Yeah, Yeah … So What About Visa?!

Visa is a long term hold (1 to 5 years). It could experience rocket growth, or it could experience very conservative growth. I can’t tell the future. No one can.

But we can learn from history. Huge ROI, limited-risk opportunities do not come everyday. You have to be ready to jump on them when they come along. So I’d say Visa is a great place to park some cash if you’re getting in now.

And then, watch, wait, and listen. When another killer opportunity comes along, you can cash out a few lots of V or whatever and jump on it.

Always watch what’s coming down the chute.

Your ball 43 is in there somewhere.