When it comes to picking stocks, or picking a winner in anything, everybody’s got a system. A magic calculation that can tell the future.

Well, here’s mine …

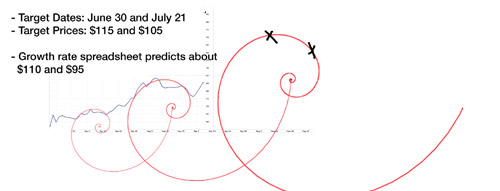

Above, you can see a historical stock graph and 3 spiral swirls. But not just any kind of spirals … golden spirals. The golden spiral is based on the golden ratio. Otherwise known as Phi.

Phi is a mathematical pattern that we see everywhere in nature, from the shape of seashells to the very structure of our galaxy. It’s everywhere. The Golden ratio which is 1 to 1.618 is often viewed as the measure of perfection. It’s amazingly aesthetically pleasing to the eye and it’s used in graphic design a lot (called the rule of thirds).

Phi is so ingrained into everything around us that many scientists believe it holds the key to unlocking the greatest prize that physics has to offer; the grand unified theory. I tend to agree.