When it comes to picking stocks, or picking a winner in anything, everybody’s got a system. A magic calculation that can tell the future.

Well, here’s mine …

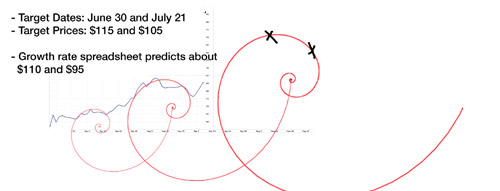

Above, you can see a historical stock graph and 3 spiral swirls. But not just any kind of spirals … golden spirals. The golden spiral is based on the golden ratio. Otherwise known as Phi.

Phi is a mathematical pattern that we see everywhere in nature, from the shape of seashells to the very structure of our galaxy. It’s everywhere. The Golden ratio which is 1 to 1.618 is often viewed as the measure of perfection. It’s amazingly aesthetically pleasing to the eye and it’s used in graphic design a lot (called the rule of thirds).

Phi is so ingrained into everything around us that many scientists believe it holds the key to unlocking the greatest prize that physics has to offer; the grand unified theory. I tend to agree.

What Stock is This?

The stock is one of my favorites; Visa. In my graph, the first two spirals track actual rises in the stock. The third spiral predicts the next rise and fall. I also keep a spreadsheet that tracks the weekly compound growth of both Visa and Mastercard and I’ve put the Visa numbers in the graph for additional reference.

Are You Serious?

[Dramatic pause] … Hell no.

First, let me say there are a number of REAL technical indicators including historical performance, investor sentiment, and corporate fundamentals that make these predicted numbers very possible.

But I’d never make a trade decision based on my pretty little spirals. Or anyone else’s. Here’s why …

There’s a fundamental PROBLEM with any system that tries to predict the future. And it’s called the Heisenberg Principle. Which basically states that if you make a prediction, and then act on that information, your actions will have an impact that changes the future. Thus, whatever you predicted won’t happen.

I’m talking about this because I see a lot of advertisements for amazing stock trading “systems” out there. Don’t get duped.

I’m sure some of them have some success here and there. But according to the laws of physics, the more people that use a successful “beat the market” system, the less chance it has of success. The more people that game a future prediction, the more impact there is that will void that prediction.

Of course, there’s always the theory of self-fulfilling phrophecy.

Now there’s a system.

I agree with you on that “the more people that use a successful “beat the market” system, the less chance it has of success”, because the wide general usage of any predictive system destroys it and a new one must be created to predict patterns that arise from the usage of the destroyed system- although the destroyed system is quickly abandoned because it is then non-functional.

However, I must say in all honesty and humility, there are patterns and more so systems incorporated into larger systems. And Phi is appears to structure many of these systems in one way or another.

I can’t give out too much information but Gann was correct, though he did not reveal the entire key to the method, he did hint several truths. Time and Price, is one of the most important hints. I stumbled upon the importance of time and price a few months ago, however, not until I recently rediscovered some of his work and read the importance of time and price did I fully understand, so much so that it gave me goose bumps.

Best regards,

C

Sorry about the typos, it’s too late at night for such perfection.

Oh and the Heisenberg uncertainty principle applies to quantum systems, that is, particles, the very very small. Not to large systems, as the measurement of particles by means of reflection of course changes the the particle. Larger systems are immune to the effects of individual observation, and many systems are rather driven by observation as a foundation.

Hey Cage,

Correct; the Heisenberg Principle is specifically geared towards the quantum level of things, but in the macro world it holds a lot of water. When it comes to investing, you can build a trending system based on observation, but if you want to make money, you have to jump in and work that system … suddenly, you’re no longer an observer and you’re creating an impact on what you were previously just observing. That impact changes the future.

As far as Gann and “systems within systems”, there’s a lot of common sense in this …

For example, if the Dow is trending up and Nasdaq is trending down, then you have a better chance of going long on Dow stocks. To go further, if financials are trending up and energy stocks are down, then, financial stocks on the Dow will be a stronger play than energy stocks on Nasdaq.

I’m speaking more to the idea of Phi and trends within trends. Gann’s methodology is a way of finding those trends mathematically rather than fundamentally.

My real point with this post is that no system is absolute.

Some people will find success with Gann’s methods. Others will not. Not all of Richard Dennis’s famous turtle traders found success. Especially once they were out on their own. Others did very well.

There are a lot of people out there peddling “amazing” trading “systems”. Most are garbage. None are a substitute for your own brain.

It was in Chaos, Solitons & Fractals, Vol. 14, p. 369, 2002. The paper by El Naschie was entitled On the exact mass spectrum of quarks. This is the first time I saw the ratio of two elementary particle masses to be equal to the golden mean. This is an exact result which follows from his four dimensional fusion algebra. Now everyone is talking about fractals in quantum mechanics and the golden mean. Very recently Ali Yazdani at Princeton University, USA observed fractals in quantum mechanics. The golden mean is related to area preservation as noted by El Naschie. A golden mean scaling plays a similar role in fractal trees. Before El Naschie no one related these things to quantum mechanics. The Egyptian had the right intuition right from the start and he should be commended for his achievements several decades before anyone else. I find the attacks on him a clear sign of something malignant in our scientific community.

One has to be totally blinded by hatred not to acknowledge that the golden mean in quantum mechanics is the greatest surprise ever confirmed experimentally in the recent history of quantum mechanics. I for one was skeptical about El Naschie’s golden mean quantum mechanics. I was skeptical because I did not do the calculations for myself. I relied on hearsay and that there are many extravagant claims made in science based on the golden mean. That was my prejudice and my mistake. Doing the elementary calculation of the two slit experiment with quantum particles using El Naschie’s golden mean topological probability was a unique experience. See this confirm now in the laboratory is almost a divine experience. This is Paul Dirac’s criteria of beauty taken to its ultimate. It is breathtaking to know that nature is that subtle and that beautiful. Even someone who is as down to earth as Gerard ‘tHooft must admit that El Naschie’s quantum golden field theory is breathtaking in its simplicity and aesthetics. Maybe I am being over the top for the moment but you do not get every day an exact irrational value such as the golden mean coming out of a laboratory testing a fundamental theory.